caTEGORIES

Tags

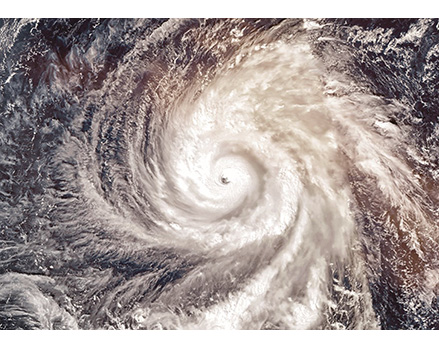

Fastener sector facing the Perfect Storm

Posted: May 19, 2021

Categories: News

Tags: Costs

Where it all starts unravelling is the supply side, for virtually every manufacturing sector, including fasteners. Where to start? Steelmaking raw materials; availability and cost of any grade of steel, and many other metals? Global container freight availability and cost? Workforce availability? Constrictive trade measures?

Global steel capacity has simply not kept pace with the upsurge in demand.With the exception of China, steel capacity was definitely slow to return online from widespread shutdowns when Covid-19 first struck. While there have been questions about whether the steel industry hung back in order to push up prices, there are unquestionably structural reasons for the lag. Shutting down a blast furnace is complex enough, restarting takes far more time and effort.

It’s also a prerequisite that demand will be sufficient to sustain a 24/7 production process. Actually, world crude steel output in Q1 2021 increased to 487Mt, some 10% higher than the same period 2020, and Q1 2020 output was virtually unchanged year-on-year1 – so there has been real output growth. However, that growth is imbalanced. Asian output has increased 13% in Q1 2021 and that primarily means China. European Union output increased 3.7% year-on-year, but North American output declined by more than 5%. Global demand, though, continues to outstrip supply, with consequent rampant price escalation. More damaging in many respects are lead times that initially more than quadrupled and now extend well beyond that, if indeed availability exists at all.

As steel production ramps up, the costs of input materials are also surging to record highs. As this is written, iron ore costs have surpassed 2011 record levels and are nudging US$200/tonne. Coking coal costs have similarly escalated, as have those for scrap.

Many fastener factories across the world are simply declining to accept orders at any price, even from regular, major customers, because they are unable to secure wire. Where orders are being accepted, quoted production lead times in Asia are typically eight to ten months, although we’ve heard some instances of more than a year.

Another increasingly reported factor, is shortages of production personnel. In some countries that is a consequence of continued coronavirus outbreaks and/or restrictions, with India almost certainly the worst hit. However, even in countries with blessedly low infection levels, for example Taiwan, factories cannot hire enough labour, skilled or otherwise, to meet increased demand. Talking of Taiwan, anyone following news of the global shortages of semi-conductors, will also know that country is suffering unprecedented drought conditions currently, impacting the whole spectrum of manufacturing.

Two consequences are inevitable. Fastener manufacturers and distributors simply cannot absorb the current extraordinary levels of inflation – not if they are to survive as a business – and have to pass on substantial and multiple cost increases. Isolated shortages of some fastener types in the distribution supply chain are now becoming widespread. One wholesaler recently received more than forty containers of screws – more than two-thirds was absorbed by back orders and there is no way of anticipating when further stocks will be received.

Then, of course, there is the global freight industry, which has already gone through six months of radical container shortages. China’s rapid recovery from the pandemic initiated that crisis, exacerbated by the Christmas peak season demand. Then, the coronavirus impacted container handling, particularly in North America, slowing the return of the boxes to ports of origin. By the beginning of 2021 freight costs had multiplied several-fold – in some cases six times higher than a year earlier. By early March there were faint glimmers of improvement in container availability and some softening of freight rates.

That was until 23rd March, when a 400m long container vessel lodged across the Suez Canal for six days. This might not seem that long, but it could take up to nine months before the global container freight industry fully normalises as a result. The ultra large container vessels that now ply most routes, whilst slower steaming to conserve fuel, may only make four complete ‘loops’ a year. So, a six day delay, compounded by the inevitable port congestion that follows it, knocks everything out of kilter. Ships and boxes are now all out of position.

At the beginning of the year there were protests that the shipping industry was constraining capacity to boost rate levels. Maybe so. However, latest reports indicate that less than 1% of the entire global container fleet is now idle. New, even bigger vessels are being ordered – but will not come into service until 2023. So serious is the ship availability, that lines are reported to be transferring smaller coastal container vessels to deep sea routes, good reason – if the Ever Given was not enough – to ensure your container is insured.

So, freight costs are ratcheting upwards and show every sign of exceeding February’s peaks. Once again, it’s availability that counts – and there isn’t any. Certainly, on Asia to Northern Europe routes, importers are being told there is no shipping space until well into June. Sailings have simply been blanked because ships are out of position. New containers, costing double because of steel, have been brought into service. However, port congestion and slow box return continues to be a major issue. The worry now is that the peak season is not that far off; consumers in the US have received a financial boost from President Biden’s recovery plan; and there are pent up consumer savings in most economies itching to be spent.

Did we mention regulatory impacts? President Trump applied US ‘Section 301’ tariffs on imports of fasteners alongside other products from China. Although the WTO subsequently ruled these tariffs contrary to world trade rules, incoming President Joe Biden has so far chosen to maintain them. All trade remedies distort the market – that is their purpose, although all too often the distortion has unintended consequences. These tariffs resulted in major volumes of US fastener orders being diverted from China to other Asian sources, including Vietnam and Taiwan.

In December 2020, the European Commission initiated anti-dumping proceedings on imports of fasteners from China. It’s not for this magazine to prejudge the outcome of the Commission’s investigation – the ‘predisclosure’ of its provisional measures will be published in June. However, the very existence of the investigation means importers, all too aware of the previous fastener tariff levels of 85%, have not dared place orders on Chinese factories, which might arrive after the July date on which provisional measures are scheduled to be applied. Conversely, Chinese factories are refusing to accept orders, for fear they would be cancelled when/if anti-dumping measures are applied.

With US importers having absorbed capacity elsewhere in Asia, and steel availability critical, options for European importers are severely limited. The trouble is coronavirus travel restrictions make it near impossible to carry out physical audits of new suppliers to assess quality and manufacturing capability.

Place orders in Europe, then. Not so easy. European fastener production capacity is reportedly overloaded, with virtually no additional raw material to be obtained. Steel safeguarding measures, placing quota limits on imports of wire and bar, also limit flexibility to source wire from outside the EU. We’re hearing that lead times from European fastener plants, assuming they are prepared to accept the order at all, are between five and six months.

Two thoughts to conclude. Firstly, whatever the legitimacy for anti-dumping measures on Chinese fasteners, the timing could not have been worse and the consequences, if significant tariffs were to be applied similar to those in 2008, will seriously impact European fastener consumption industries. The other thought is simply to reflect on how important fasteners really are. Not just to those within the industry who, perversely perhaps, love these miniature pieces of engineering, but to all those consuming industries, which – dare we say – regularly undervalue and take them for granted. Fasteners rarely account for more than one percent of the value of a finished product or structure. However, if they are not there, that product or structure simply cannot be completed. The reality for any fastener consumer right now is that continuity of supply overrides cost and that having to accept higher prices is infinitely better business than halting production.

So, Perfect Storm? Media is often accused of being prone to exaggeration. In this case, we suspect, if anything we’ll be accused of understating the reality.

From Fasteners + Fixings Magazine

19 May 2021